Doha Guides Team regularly reviews this article to ensure the content is up-to-date and accurate. The last editorial review and update were on 18 February 2025.

What is End of Service Gratuity?

According to Qatar Labour Law, End of Service Gratuity is a sum of money stipulated to be paid to an outgoing employee based on the service period. This is calculated based on your employment contract and the number of years you have worked for the company.

This article explains the Labour Law regarding End of Service Gratuity and how you can calculate the end-of-service gratuity using the online tool provided by the Ministry. We have also included a Free Qatar Gratuity Calculator in English.

Qatar Gratuity Calculator in English

Qatar’s Ministry of Labour provides an online service that allows applicants to calculate the end-of-service gratuity on its official website. However, this page is only available in Arabic.

For your convenience, DohaGuides.com has developed a similar online calculator in English. You can check the calculator below:

Note that you must enter data as per the contract signed between you and your employer.

Please note that you are not eligible for End of Service Gratuity if your service is less than one year.

This calculator will give you an approximate amount of your end of service gratuity. The exact amount would be based on your company’s HR policies.

How to Calculate Gratuity in Qatar 2025

For those who are looking for quick info, let’s summarise the law:

- An employee is eligible for gratuity if he has worked for at least one year.

- The minimum gratuity payable is 21 days basic salary per each year.

- The last basic salary shall be the base for gratuity calculation.

- The employer is entitled to deduct from gratuity any amount due to be paid by the worker. [2]

Sample Computation of Gratuity in Qatar

Let’s illustrate this with an example. Suppose your basic monthly salary is 1,500 QR and you have worked for 5.6 years with the same company.

First, calculate your daily basic salary:

Daily basic salary = (monthly basic salary) / 30 (days)

Daily basic salary = 1500 ÷ 30 = 50 QR per day

Now, calculate your gratuity for 5 years:

Gratuity = (number of completed years) x (21 days per year) x (daily basic salary)

Gratuity = 5.6 x 21 x 50 = 5,880 QR

So, in this example, you would be entitled to a gratuity payment of 5,880 QR when you leave the company after completing 5.6 years of service with your 1,500 QR basic salary.

End of Service Gratuity: What the Law Says

The end of service gratuity is calculated under Labour Law No. 14 of 2004.

Upon termination of the employment contract, an employee is entitled to an end-of-service gratuity and leave salary. Under Article 54 of the Labour Law (Law No. 14 of 2004), the employee is eligible for a minimum of three weeks’ basic salary as an end-of-service gratuity for each year.

| Service Period | Gratuity Amount |

|---|---|

| Less than one year | No gratuity |

| One year and more | 21 days basic salary per year |

As per Article 54 of Law No 14/2004:

“The employer shall pay at date of termination the end of service gratuity in addition to any amounts due to the worker who spent one year or more in employment. This gratuity shall be agreed upon by the two parties, provided that it is not less than a three-week remuneration for every year of employment. The worker shall be entitled to gratuity for the fractions of the year in proportion to the duration of employment.

The Worker’s employment shall be considered continuous if it is terminated in cases other than those stipulated in Article 61 of this Law and is returned back to Work within two months of its termination.

The last Basic Wage shall be taken as the basis of the calculation of the gratuity.

The Employer shall be entitled to deduct from the service gratuity the amount owed to the employer by the Worker.”

Vacation Pay

As per Article 81 of the said law, if the employment contract is terminated for any reason before a worker takes his vacation (annual leave), he shall be entitled to payment instead of annual leave equivalent to his wage for the leave days to which he is entitled [1].

Flight Tickets

When the employment contract is terminated, the employer is responsible for repatriating the employee back to the place from where he was recruited or any other place agreed by the parties. However, if the worker joins another employer before departure from the country, this obligation shifts to the new employer.

Gratuity During Unpaid Leave

If the employee takes unpaid leave, this period is excluded from the service period calculation. As a result of unpaid leave, the period of service is reduced by the number of days served as unpaid leave.

Qatar Labour Law on Gratuity After 5 Years

Many readers ask us if the gratuity is higher if an employee has worked for more than 5 years.

The reason for this question is that there was such a clause in the previous labor law. However, this is not the case anymore.

The clause that stated a worker should be paid four weeks/year for working 5-10 years and five weeks/year for more than ten years was part of the old labor law and is no longer valid.[3]

As per the current law (Law No 14 of 2004), gratuity shall be agreed upon by employer and employee, provided that it is not less than a three-week remuneration for every year of employment.

Qatar Labour Law on Gratuity After 10 Years

As previously explained, the gratuity calculation remains unchanged even if the employee has worked for more than 10 years. It will still be 21 days basic salary per each year.

NOTE: The labour law only states the minimum gratuity. Some companies may choose to pay more than three weeks’ salary to employees based on their length of service. This is up to the management’s decision and HR policies.

Can Employer Terminate Employees Without Gratuity?

According to Article 61 of the Labour Law, there are certain situations under which an employer may dismiss an employee without the payment of the end of service gratuity. Instances of such gross misconduct include:

- If the Worker assumes a false identity, alleges a nationality other than his or submits false certificates or documents.

- If the Worker commits a mistake which causes gross financial loss to the Employer provided that the Employer shall notify the Department of the mistake within twenty-four hours from the time of awareness thereof.

- If the Worker violates more than once the written instructions of the Employer concerning the safety of the Workers and the Establishment despite being notified in writing of the violation on condition that such instructions shall be written and posted up in a conspicuous place.

- If the Worker fails more than once to carry out his essential duties under the Employment Contract or this Law despite being notified in writing thereof.

- If the Worker discloses the secrets of the Establishment where he is employed.

- If the Worker is found during the working hours in a clear state of drunkenness or under the influence of a drug.

- If the Worker assaults the Employer, the manager or one of his supervisors in the workplace during the working day or by reason thereof.

- If the Worker repeats the assault on his colleagues in the workplace despite being warned in writing thereof.

- If the Worker absents himself from Work without legitimate cause for more than seven consecutive days or fifteen interrupted days in one year.

- If the Worker is convicted by a conclusive judgment in a crime of dishonour or dishonesty.

Will Gratuity Be Paid in Case of Worker’s Death?

According to Article 55 of the Labour Law, if the worker dies during the service, regardless of the cause of death, the employer shall deposit with the treasury of the competent court any wage or other entitlements due to the worker in addition to the end of service gratuity within a period not exceeding fifteen (15) days from the date of the death.

The minutes shall contain a detailed report indicating the method of calculating the amounts referred to. The employer shall deposit a copy of the minutes with the Department.

The competent court shall distribute the deposited amounts among the deceased worker’s heirs. This shall be done in accordance with Islamic Sharia provisions or the Personal Status Law applicable in the deceased worker’s home country.

If three years have elapsed since the date of the deposit without the person deserving the due amounts being known, the court shall transfer these amounts to the State Public Treasury.

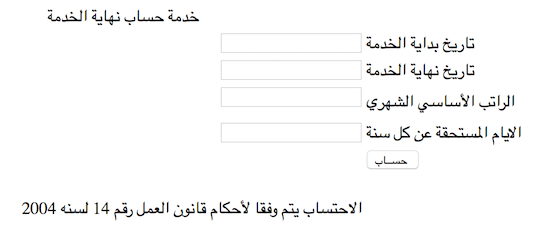

Calculate Gratuity on Ministry Website

You can also calculate the end-of-service gratuity on the Ministry of Labour website. This is done by entering your joining date, last working date, basic monthly salary and the number of gratuity days due each year.

Although the service is available only in Arabic, non-Arabic speakers can also easily calculate ESB by following these steps:

STEP 1: Click on this link to open the calculation page. You will see the following fields in Arabic:

STEP 2: In the first field, enter your Date of Joining (as per your contract).

STEP 3: In the second field, enter your Last Working Date.

STEP 4: In the third field, enter your Basic Monthly Salary (as per your contract).

STEP 5: In the fourth field, enter the Gratuity Days accrued for each year (for example, 21 days for one year). You have to refer to your contract for this.

STEP 6: Click the bottom button to see the result.

This service was introduced to ensure greater transparency and make foreign employees aware of their rights.

Leaving Qatar? Travel in style!

We highly recommend Qatar Airways for your trip from Qatar. It is known for its exceptional passenger comfort and safety, offering great deals that can make your travel more budget-friendly. Check out the latest offers from Qatar Airways for a rewarding travel experience.

FAQ on End of Service Gratuity in Qatar

How is the end of service gratuity computed?

End of service gratuity is calculated based on the employment contract and the number of years the employee has worked for the company.

How much is the minimum gratuity in Qatar?

According to Law No. 14 of 2004, for each year of employment, the employee is eligible for a minimum of three weeks’ basic salary as the end-of-service gratuity.

How can I calculate the end of service gratuity?

You can calculate end of service gratuity online by going to the end of service gratuity calculator on the Ministry website.

What can I do if my employer refuses to pay end of service gratuity?

If your employer refuses the end of service gratuity without any reason, you can file a complaint at the Ministry of Labour.

I am working with the same company since 1990. Am I entitled to receive gratuity from 1990 or only from 2004?

If the person is working with the same company, he is entitled to gratuity from the date of joining. In this case, he is entitled for gratuity from 1990.

READ NEXT: How Expatriates Can Change Jobs in Qatar

Related Articles:

- How To Check Qatar Travel Ban (3 Easy Ways)

- How to Change Job in Qatar Without NOC

- Qatar Labour Law on Working Hours and Overtime

- Qatar Labour Law on Sick Leave and Maternity Leave

- Qatar Labour Law on Annual Leave and Holidays

- 11 Easy Ways To File Labour Complaint In Qatar

- Freelance Visa In Qatar: Is It Legal?

Copyright © DohaGuides.com – Unauthorized reproduction of this article in any language is prohibited.

References:

[1] Law No. 14 of 2004 – Article 81

[2] Law No. 14 of 2004 – Article 54

[3] Law No. 14 of 2004 – Article 13 is about repealing Law No. 3 of 1962 – Article 24

Aneesh, the Founder & Editor of DohaGuides holds a Master’s Degree in Communication & Journalism, and has two decades of experience living in the Middle East. Since 2014, he and his team have been sharing helpful content on travel, visa rules, and expatriate affairs.

have a good day to you I am 5 years with my company I resign after 5 years I don’t Go vacation my basic salary is 1000 this 18 February my company booked my ticket but they said they give me only 1000 gratuity for 5 years can you please tell me how much should I get and what to do

I hope you’re doing well. I have a question regarding my salary structure.

I joined the company in 2014 as a Senior Foreman and have since been promoted to Site Supervisor, Site Engineer, and finally Senior Site Engineer. My current basic salary is 5700 QAR, and I wanted to clarify whether this amount is based on my current position only, or if it reflects a cumulative salary for all the roles I have held since joining the company.

Hi my work period from Nov 5th 2023 to Jan last 2025 (1year and 3 months).I got terminated recently, as per our contract leave salary and airticket is on every 2 year. So whether i am eligible for leave salary,airticket and gratuity or only gratuity.

i have been working in a company since 2014 until now still working. that’s 10 years 6 months. my basic salary is 1000qr ,how much will be my gratuity?

When I joined company my salary was 1400 qr now my salary 1900 qr I have been working since April 23 04 2015 to till how will be gravity if I resign next month

I joined this company on May 2018 June 15, that time my basic salary was QR 750. Then from July 2021 my basic salary became QR 1000. So how much will be my final gratuity till June 2025.

Hello, I have been in a company for six years. How many days will be calculated? Is it 21 days or 28 days?

I have been working in the same company since 1998 in Qatar. How and when can I get my graduation please?

Hi Acharya, your gratuity and salary balance should be paid after your resignation/termination (before you are sent back to your home country).